Spain, with its vibrant culture and stunning landscapes, has long been a dream destination for many. Whether you envision sipping sangria on a sun-drenched terrace or exploring historic streets lined with charming boutiques, the allure of living in this beautiful country is undeniable. But what about the practicalities? The housing market can be complex and daunting to navigate, especially if you’re unfamiliar with local trends.

Understanding how much homes cost across Spain is crucial before making any decisions. Prices vary significantly from bustling cities to tranquil coastal towns. With factors like economic shifts, changing demographics, and even global events shaping the landscape, staying informed is key.

So let’s dive into everything you need to know about the current state of housing prices in Spain. From identifying hotspots for investment to weighing your options between buying and renting—this guide will provide valuable insights tailored just for you!

Understanding the Current Housing Market in Spain

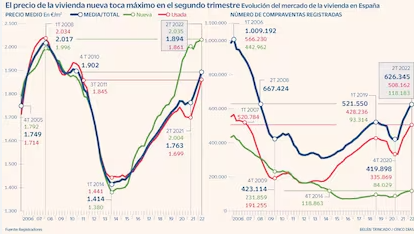

The current housing market https://finanzasdomesticas.com/el-precio-de-la-vivienda-en-espana in Spain is a dynamic landscape influenced by various factors. After years of recovery from the financial crisis, prices have steadily climbed, making homeownership more appealing yet challenging for many.

Major cities like Madrid and Barcelona lead the charge with rising demand. These urban centers attract professionals seeking job opportunities and families looking for vibrant communities.

Conversely, rural areas offer unique charm at more affordable prices. As remote work becomes normalized, people are increasingly exploring these options, shifting interest away from traditional hotspots.

Interest rates play a significant role as well. Low borrowing costs encourage buyers to take the plunge while investors look to capitalize on potential returns in an evolving market. With so much fluidity in trends and preferences, understanding local nuances is essential before diving into property decisions in Spain’s ever-changing environment.

Factors Affecting Housing Prices in Spain

Several factors influence https://finanzasdomesticas.com/el-precio-de-la-vivienda-en-espana housing prices in Spain. The economy plays a significant role. When economic growth is strong, demand for homes rises, pushing prices higher.

Location also matters greatly. Major cities like Madrid and Barcelona often see inflated prices due to high demand and limited supply. In contrast, smaller towns may offer more affordable options.

Government policies can impact the market too. Incentives for first-time buyers or changes in tax laws can either stimulate or cool down buying activity.

Additionally, interest rates affect affordability. Lower rates generally encourage more people to buy homes, while higher rates may deter potential buyers.

Cultural trends shape preferences for urban versus rural living. As lifestyle choices evolve, so do the dynamics of property pricing across various regions in Spain.

The Most Expensive and Affordable Cities in Spain

When it comes to housing prices in Spain, there’s a striking contrast between cities. Madrid and Barcelona consistently rank as the most expensive places to live. With their vibrant culture and economic opportunities, these metropolises attract both locals and expatriates alike.

On the flip side, smaller cities like Granada and Valencia offer more affordable options. Here, you can find charming neighborhoods without breaking the bank. The cost of living is significantly lower, making them attractive for families or young professionals looking for a balance between quality of life and budget.

Additionally, towns along the Costa del Sol have seen fluctuations in price but often provide good value compared to larger urban centers. Each city has its unique character that plays into property values—understanding this dynamic is crucial when exploring your housing options in Spain.

Tips for Buying a Home in Spain

Buying a home in Spain can be an exciting adventure. Start by setting a realistic budget that includes not just the purchase price but also taxes, fees, and maintenance costs.

Research is key. Spend time exploring different regions to find where you feel most at home. Each city has its own character and lifestyle, so consider your long-term needs.

Engage with local real estate agents who understand the market dynamics well. They can provide insights into neighborhoods and help navigate legal procedures.

Don’t rush into decisions; take your time visiting properties to get a true sense of their value.

If you’re not fluent in Spanish, think about hiring a translator or bilingual lawyer to assist you through contracts and negotiations for added peace of mind during this process.

Renting vs. Buying a Home in Spain

When considering whether to rent or buy a home in Spain, personal circumstances play a crucial role. Renting offers flexibility, perfect for those who may need to relocate frequently or are uncertain about settling down.

On the other hand, buying can be an excellent long-term investment. Property values tend to appreciate over time, especially in popular areas. Homeownership also provides stability and the freedom to personalize your space.

However, it’s essential to consider additional costs associated with purchasing property—taxes, maintenance fees, and potential renovations can add up quickly.

Renting usually requires less upfront cash and allows you to avoid market fluctuations. It depends on your financial situation and lifestyle preferences. Evaluate your goals carefully before making this significant decision in the Spanish housing market.

The Impact of COVID-19 on the Spanish Housing Market

The COVID-19 pandemic significantly reshaped the Spanish housing market. Initially, uncertainty led to a slowdown in transactions as buyers and sellers hesitated. This pause caused many property prices to stagnate or even drop in some regions.

As remote work gained traction, demand shifted from urban centers to suburban and rural areas. People sought larger living spaces away from crowded cities, driving up prices in traditionally overlooked locations.

Government measures like mortgage deferrals helped stabilize the market during turbulent times. However, as restrictions eased, pent-up demand surged. Buyers returned with renewed urgency, leading to increased competition for desirable properties.

While the pandemic brought challenges, it also spurred changes that could redefine preferences in homebuying for years to come. The landscape of Spain’s housing sector is evolving rapidly as new trends emerge amidst recovering economic conditions.

Conclusion: Is Now a Good Time to Buy or Rent a Home in Spain?

As you weigh your options in the housing market, it’s crucial to consider various factors before making a decision. The current landscape shows fluctuating prices and trends influenced by economic shifts and regional variations. Whether you’re contemplating buying or renting, each choice has its own set of advantages.

If you’re leaning towards buying, assess your financial situation carefully. With interest rates and property values varying significantly across regions, conducting thorough research will ensure you’re making an informed commitment.

On the other hand, if flexibility matters more to you right now, renting could be the better path. It allows for adaptability in a rapidly changing economy while still providing shelter without long-term obligations.

Timing can play a vital role in this decision-making process. Keep an eye on market indicators and emerging trends that may affect both rental prices and home values moving forward.

Deciding whether it’s the right moment to buy or rent requires careful consideration of personal circumstances along with insight into broader economic conditions in Spain’s real estate sector. Your choices today can shape your future living situation significantly—so choose wisely!