Trading can seem like a mysterious world filled with charts, numbers, and strategies that only the experts understand. Yet, it’s a realm that anyone can enter with the right knowledge and tools. If you’ve ever wondered how traders make their decisions or what keeps them ahead of market trends, you’re in the right place. In this post, we’ll unravel the concept of trading strategies—what they are, why they matter, and how you can craft your own to navigate this exciting landscape effectively. Whether you’re a beginner looking for guidance or an experienced trader seeking fresh insights, knowing how to develop a solid trading strategy is key to your success in this fast-paced environment. Let’s dive into it!

Understanding the Basics of Trading

https://onlypc.net/que-es-una-estrategia-de-trading Trading is essentially the act of buying and selling assets, such as stocks or cryptocurrencies, with the goal of making a profit. It’s not just about guessing which direction prices will go; it’s about understanding market behavior.

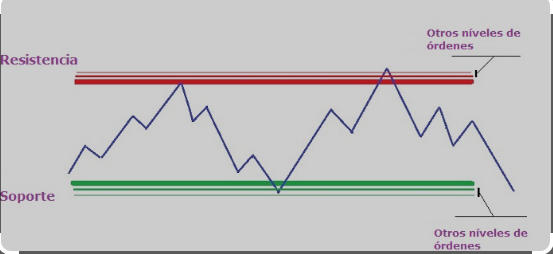

At its core, trading operates on supply and demand principles. When more people want to buy an asset than sell it, prices rise. Conversely, if there are more sellers than buyers, prices fall.

Traders analyze various factors that influence these price movements. This includes economic indicators, company performance reports, and even geopolitical events.

Having a firm grasp of these basics sets the foundation for successful trading decisions. Whether you’re looking at charts or reading news articles, every piece of information can impact your choices in this dynamic environment.

What is a Trading Strategy?

A trading strategy https://onlypc.net/que-es-una-estrategia-de-trading is a well-defined plan that outlines how to buy and sell assets in the financial markets. It serves as a roadmap, guiding traders in decision-making when they enter or exit trades.

At its core, a trading strategy combines various elements such as market analysis, risk management, and trade execution. This blueprint helps traders capitalize on opportunities while minimizing risks associated with volatile markets.

Traders often develop strategies based on technical indicators, fundamental analysis, or even sentiment analysis. The key is consistency; sticking to the plan can lead to better outcomes over time.

Additionally, having a predefined strategy allows for emotional discipline. Traders are less likely to make impulsive decisions driven by fear or greed when following their established guidelines.

Why is a Trading Strategy Important?

A trading strategy is crucial for anyone venturing into the financial markets. It serves as a roadmap, guiding traders through complex decisions and chaotic market movements.

Without a solid strategy, emotions like fear and greed can lead to impulsive actions. These reactions often result in significant losses or missed opportunities.

Having a well-defined plan allows traders to focus on their goals. It helps in managing risk effectively while capitalizing on potential profits.

Moreover, an effective trading strategy promotes consistency. When you stick to your plan, you’re less likely to deviate from it during turbulent times.

This discipline fosters confidence over time. As traders gain experience with their strategies, they develop a deeper understanding of market dynamics.

A robust trading strategy transforms uncertainty into structured decision-making. This enhances the chances of long-term success in the ever-evolving landscape of trading.

Types of Trading Strategies

Trading strategies come in various forms, each catering to different styles and market conditions. One popular type is day trading, where traders buy and sell within the same day to capitalize on small price movements.

Swing trading takes a longer view. Traders hold positions for several days or weeks, aiming to profit from expected upward or downward shifts in stock prices.

Position trading requires patience. Here, investors maintain long-term holdings based on fundamental analysis rather than short-term fluctuations.

Scalping focuses on making quick trades for small profits throughout the day. This strategy demands high concentration and fast execution.

Algorithmic trading relies on computer programs to execute trades automatically based on predefined criteria, maximizing efficiency and speed.

Understanding these variations can help you choose a strategy that aligns with your goals and risk tolerance. Each style offers unique advantages worth exploring further.

Developing Your Own Trading Strategy

Creating your own trading strategy can be an exciting journey. It starts with understanding your goals and risk tolerance. Ask yourself what you want to achieve in the market—are you looking for short-term gains or long-lasting investments?

Next, research different types of analysis that resonate with you. Technical analysis focuses on price movements and patterns, while fundamental analysis dives into a company’s financial health. Choose one or blend them according to your comfort level.

Testing is crucial. Use paper trading platforms to simulate trades without risking real money. This practice helps refine your approach and build confidence.

Keep track of your performance over time. Documenting successes and failures allows you to adjust as needed. Remember, flexibility is key; markets are unpredictable, so adapt when necessary for continued growth.

Common Mistakes to Avoid in Trading Strategies

Many traders fall into the trap of overtrading. This often leads to impulsive decisions based on emotions rather than logical analysis. It’s essential to stick to your plan and avoid deviating due to market fluctuations.

Another frequent mistake is neglecting risk management. Failing to set stop-loss orders can result in significant losses that could have been easily avoided. Always define how much you’re willing to lose before entering any trade.

Additionally, some traders overlook the importance of backtesting their strategies. Testing a strategy against historical data offers valuable insights into its effectiveness and potential pitfalls.

Keeping unrealistic expectations can be detrimental. Trading isn’t a guaranteed way to wealth; it requires time, patience, and continuous learning. Adjusting your mindset about gains will create healthier trading habits in the long run.

Conclusion

Trading is a dynamic and often challenging endeavor. Understanding the basics sets the foundation for success, while a well-defined trading strategy can be your roadmap in navigating market fluctuations. It’s crucial to recognize that every trader should develop their own approach tailored to personal goals and risk tolerance.

Exploring different types of strategies reveals that there’s no one-size-fits-all solution; each method has its unique strengths. As you craft your strategy, being mindful of common pitfalls can help you maintain discipline and adapt effectively over time.

The journey doesn’t end with creating a strategy; it requires continuous learning and adjustment as market conditions change. Embracing this process will not only enhance your trading skills but also instill confidence in your decision-making abilities.